The UK government is set to announce funding for artificial intelligence (AI) and robotics research as part of the government’s strategy to help UK businesses maximize investment and trade opportunities.

Culture Secretary Karen Bradley is expected to make the funding announcement on Wednesday as part of the British government’s digital strategy.

The research, which will be carried out by top British universities, will have a fund of £17.3 million. The grant will come from UK’s Engineering and Physical Sciences Research Council.

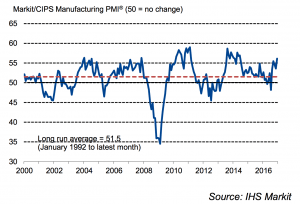

The funding support came after recent research revealed the potential long-term impact the AI and robotics field could have on UK’s economy. Accenture, last year, published a report projecting that AI could contribute up to £654 billion to the British economy by 2035.

BenevolentAI CEO Jerome Pesenti, who previously served as chief data scientist at IBM and Computer Scientist Dame Wendy Hall, who is currently a professor at University of Southampton, have been commissioned to review the status of UK’s artificial intelligence sector. The review aims to pinpoint areas of opportunity for UK’s growing AI research industry.

In a statement, Professor Dame Wendy said she was looking forward to exploring collaboration opportunities for the government and the AI sector. She notes that British scientists, researchers and entrepreneurs have been at the forefront of AI research and development.

Demand for British expertise in the artificial intelligence field has skyrocketed in recent years.

In 2014, search giant Google acquired DeepMind, a London start-up that invented a neural network that is capable of that mimicking the short-term memory of the human brain, for $400 million. In 2015, Apple paid $250 million to acquire UK-based start-up, VocalIQ, which specializes in machine learning that enables computers to understand natural human language. Microsoft likewise shelled out $250 million to buy SwiftKey, the London-based developer of a software keyboard with advanced predictive abilities.

A spokesperson for the UK’s Department for International Trade said the government is looking to help UK businesses make the most of trade and investment opportunities through targeted support and business matching.

If you’re looking for additional funding for your project why not speak to a part time financial advisor today